FRANK by OCBC is a good example of building a holistic retail bank experience.

Customers’ behaviour and their expectations of a bank are shifting. How can your bank’s approach to branch design help you successfully engage them?

In 2010 Citibank launched its first Smart Banking Branch in Singapore, located within the Orchard SMRT train station in the middle of the main shopping district. It offered to be a ‘customer-centric environment’ with interactive screens that allow the customer to ‘browse for information on Citibank’s products and services on their own at leisure’. The then CEO of Citibank Singapore lauded it as being ‘carefully designed’ to ‘put the customer’s experience centre-stage’.

Fast forward to today and you see a wall of business suited Citibank sales people standing outside the branch, approaching shoppers and commuters that walk past. The branch has hardly anyone inside, as not many people walk into it for fear of being haggled by the suits.

A shift in the mentality

Bank branches are expensive to build and run. The effort it takes to make it attractive in such a competitive landscape is no mean feat. Banks in Singapore have been trying in recent years to transform their retail branches into something more for the customer. They spend an increasing amount of effort and resources to ensure that the branches continue to give them an edge and to win customers over by being more than a transactional space. This shift is partly due to the increasing popularity of online banking and the drop in traditional services such as making payments at bank branches or dropping cheques.

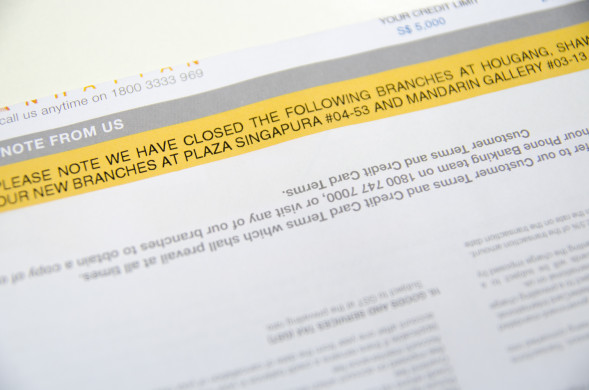

Many major banks have been either downsizing their branches or consolidating them to more strategic locations. There’s just one thing missing from their equation.

Many banks have been consolidating their branch network.

Don’t waste your retail banking expenditure

As tempting as it is to put your sales team out there to capture the passing traffic, such a strategy doesn’t give potential customers the time and space to appreciate your bank’s desired experience for them. It’s like creating a cafe and having your baristas stand outside to get customers to buy your coffee. The intrusion is not only unappreciated, it puts people off the experience altogether.

What’s more, if you removed the bank logos from some of these branches, you would be hard pressed to find the differences among them. Sure, they look nice, but simply looking classy is not going to make you memorable, especially when your sales and services processes do not align with your new retail experience. This becomes all the more crucial as more and more customers give bank branches a miss. One study even went as far as saying that close to 80% of the US market do not visit a bank branch often.

Can you tell which is which? The left is a UOB branch, and the right is a Citibank branch.

Can you tell which is which? It is a DBS Branch on the left, and a HSBC branch on the right.

In today’s environment—where competition can come from outside the industry, consumer trust is low and it’s never been easier for the customer to switch banks—banks need to be creative in standing out and being more relevant to their customers.

This means that their retail presence plays an even greater role than before in making the customer choose to bank with them, and a holistic look at the branch is required.

Make an impact to the few that go there

As people’s reaction to bank branches changes, so should the branches change to stay relevant. Banks should look at a few aspects that work closely together to create a compelling service experience for their customers. These are the branch design, the staff service levels, the integration of online and offline experiences and the products on offer.

One bank that has made bold steps in this direction is OCBC, when they launched FRANK, the financial institution aimed at Gen Y. By understanding their target customer base, they were able to create a radical experience that was perceived as refreshing and relevant.

FRANK branches were designed with the target audience in mind, and were made to look like a book or music store. Customers were left alone to browse and learn more about the products, with staff on hand to give advice and answer questions and more than 100 card designs serving as points of interest. OCBC has been clear about what FRANK branches are for and has been strategic about where to locate them. A majority of them are in tertiary institutions, and some of them do not even offer counter services. FRANK was able to translate what the brand stood for into the physical space.

FRANK branches look just like any other retail outlet, and not like a conventional bank branch.

OCBC pulled it off by thoroughly researching how their customers behaved and what they believed in before building the FRANK brand. Their bold move ultimately paid off. As of 2011, they have 26% of the youth market in Singapore, and have won several banking awards in 2012.

Can a local bank be relevant too?

Through our work with Bank Islam Brunei Darussalam (BIBD), we have been able to see that local banks are in a unique position to showcase their knowledge of the local context, which can be used to portray a closer understanding of the customer. Our research has shown that customers appreciate such an understanding.

We designed BIBD’s concept branch to reflect the family focus of their retail banking products. This meant wider walking areas for groups, bigger cabins that can fit more than two, and more seating areas for grandparents and children. The rebrand kept them at the top of the retail banking market in Brunei, and early feedback gathered since their launch in June suggested that customers felt more satisfied with their service.

If the big banks in Singapore were to transform their branch experience in a similar way, then maybe their Smart Banking Branches would see better results.

Roy Chen is a Senior Strategy Consultant at Consulus, who has worked on projects covering a wide range of Asian and European markets. He specialises in creating fresh brand experiences for products.

This article is part of The Columnist, a newsletter by Consulus that offers ideas on business, design and world affairs. For past issues, browse the complete archive.