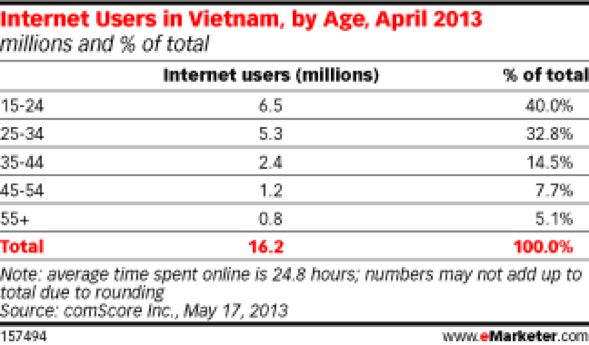

For an industry that is on the cutting edge of technology, banks are consistently behind the curve when it comes to using Social Media. Poor social media management and responses to the emerging banking crisis in the last five years have compounded upon the lack of trust already existent in the public towards banks after the 2009 financial crisis. In Singapore, the issue of banks having insufficient capability to leverage on social media has led to an inability to enhance the customer service experience. According to a 2013 World Retail Banking Report released by CapGemini, banks in Singapore are behind other developed nations in terms of customer experience. A separate report on digital marketing in global retail banking shows that banks are only in the infancy of using digital to reach out to more consumers, even though they already have the infrastructure and personnel in place to build social media strategy. Banks, more than ever, need to use Social Media to reach out to consumers and use it as a way to build a better relationship with them. Social Media is expanding at rapidly in Asia Within the region, Social Media adoption rates have soared in recent years, even in emerging economies. In April 2013 alone, Vietnamese spent a total of 4.8 million minutes on Facebook. That’s a total of 9 man years spent in just one month. As with our Vietnamese counterparts, Singaporeans are also active on Social Media, being top on Twitter in terms of users per capita worldwide. In such a communally active environment, the speed at which good and bad experiences are being shared, is at a rapid pace.

16 million Internet users in Vietnam have already embraced Social Media. (Image courtesy of eMarketer.com)

Customers have also begun to communicate directly to brands. Instead of communicating amongst themselves or sending emails to customer service, they are tweeting straight at brand pages. While this results in great social feedback from consumers, their complaints are out in the open and any wrong response from the brand can light a PR firestorm, like powder kegs waiting to be lit on fire. When DBS Bank’s ATM network went down in 2010, frustrated customers took to sharing on Twitter about the service outage. At that point in the crisis, DBS had no Twitter account and had to quickly get on the platform. What the bank did not know was that it would be starting with no followers at all, so its messages about what its staff were doing about the outage would have little or no spread on the platform. While it is a commendable effort, DBS Bank did not achieve a sufficient level of social attention to combat negative online sentiment. It was only in recent times that the bank started to use Twitter as a rapid customer service platform, giving prompt responses to anyone who tweets at its page.

So, what should banks do to ensure they do not get caught out on Social Media? They need to prime their teams using the following steps: 1) Build Social Media Responsibilities within the Organisation While many corporations can afford to outsource Social Media responsibilities to external agencies, no agency will understand the intricacies of a Bank’s operations. Additionally, having an agency in charge will add one more line of reporting, delaying rapid response in the event of a crisis. The best way for a bank to build its social media channels is via a well-informed internal team, preferably comprising social-savvy people from the corporate communications department. Placing them in charge of the social front of the bank will allow them to communicate clearly and rapidly to customers, whether the bank is in a PR crisis or not. 2) One Key Decision Point, One Compact Team If your Social Media team is already sitting within your organisation, the next step is to have all Social Media decisions, inclusive of strategy, come from this team. It is important that the team members are empowered and know the extent of their authority as brand representatives of the bank. This move is key to having a consistent and coherent stream of conversations with your audience base. The team must also be kept readily informed about any changes, especially policy changes. The team should be small and possess skill sets in the following areas:

- Copywriting and Communications

- Public Relations

- Visual Communications

- Specific Subject Matters in relation to the bank’s product offering

3) Get Personal! Brand pages that respond in corporate speak get a lot of flak, and for good reason: Online audiences today want a real person on the other side, talking to them in clear, honest language. While banks while tend to operate within strict protocols, there should always be someone to explain procedures in a friendly and understanding tone, similar to how bank tellers and branch customer service staff behave. By being friendly, helpful and genuine, your brand page will enjoy healthier interaction with customers.

Kenneth Lee is the Senior Manager for Social Strategy at Consulus. He has worked with several Asian companies in retail, banking, healthcare and media to provide strategic research, Social Media strategy, Social Media frameworks, processes and engagement strategy. Say hello to him on LinkedIn.

This article is part of The Columnist, a newsletter by Consulus that offers ideas on business, design and world affairs. For past issues, browse the complete archive.