MoolahSense is a trusted P2P lending platform that empowers investors to stimulate economic growth by providing finance directly to growth SMEs, in exchange for an attractive rate of interest. The Columnist talked to Mr Lawrence Yong, Co-Founder & CEO of MoolahSense to find out more about how this platform could help local businesses and entrepreneurs to solve financing issues.

The Columnist (TC): What inspired you to develop this web-based crowd-investing platform – Moolahsense?

Lawrence Yong (LY): I had been a practitioner in the financial sector for the past 12 years, with experiences spanning private wealth management and investment banking. During the financial crisis of 2008, I became attuned to the debate on (unbridled) capitalism. While there were many themes on the debate, it re-ignited a niggling question I had in my mind since my undergrad days about firm size bias when it comes to financing. From my professional experience, I also observed that everyday investors have limited access and choices in investments when compared to accredited investors (high net worth investors).

Intellectually, I began to question the optimality of our financial system in terms of capital allocation and meeting the broad needs and wants of its members. Post crisis, I think the disproportionate allocation of capital to large firms was further exacerbated at the expense of small firms. Further, heightened levels of investor protection – a necessary reaction to control the agency problems that contributed to the crisis, also means that the already limited investment opportunities for everyday investors have become even more curtailed.

One evening in 2012, I was in the dealing room working on a client order, awaiting New York to open. To pass time, I googled and stumbled upon the phenomenon of peer to peer lending. I was immediately drawn to the way it leverages community and technology to resolve the challenges of capital allocation. It serves a win-win solution as both the borrowers and lenders are empowered with greater access and opportunities through the platform. These platforms have become established in the US and the UK, and growing rapidly. The natural question that followed was if it would be relevant to Singapore’s context and our research and business activity show that it is.

TC: What is the difference between crowd-investing via Internet and traditional methods?

LY: Crowd-investing over the internet offers greater choices and flexibility to the everyday investor over traditional methods. One of the main draws of crowd-investing is to avail greater access to investment opportunities.

In equity and debt based crowd-investing, everyday investors become mini-angels, or mini-bankers to startups and SMEs. By pooling resources over the internet, everyday investors can participate in opportunities that are otherwise traditionally limited to affluent and institutional investors.

Crowd-investing platforms harness the power of internet technologies to lower the unit cost of discovery, distribution and evaluation to a multitude of investment opportunities. At MoolahSense, everyday investors gain access to a new asset category of investing in SME loans for an attractive rate of return in the form of fixed interests.

TC: What is your view on the current crowd-investing in Asia in general and Singapore in particular?

LY: Crowd-investing in Asia and Singapore is by and large still nascent in development. Peer to peer lending however is already prevalent in China, where there are reportedly more than 2000 platforms in operation. Much of the development is curtailed by existing regulations which had not been written to anticipate crowdfunding in the digital age.

TC: What can enterprises expect to benefit from Moolahsense?

LY: MoolahSense is a peer to peer business lending platform. We help SMEs expand their sources of loan capital by connecting them to individual investors. SMEs not only activate their social profile in the community at large to access funding but can also “bank” on their reputation to secure a lower rate of funding from the crowd. SMEs also benefit in the publicity generated from a successful crowdfunding campaign and forge a relationship of trust with their supporters.

TC: What are the potential rewards and risks for prospective investors?

LY: Potential rewards for prospective investors are accessing attractive fixed yields opportunities by directly financing local growth businesses. The risks would be losing their entire investments if the business fails.

TC: What protections exist to safeguard investors?

LY: Firstly, MoolahSense curates the businesses who are eligible to list a funding request on the platform. This includes ensuring that the business are ACRA registered private limited companies or limited liability partnerships and running some basic background checks on the business to ascertain their legitimacy. While not an endorsement, this process screens for bona fide businesses.

Once the note is issued, a legal contract is entered between the issuer and the investors. MoolahSense ensures that the contract is endorsed by the issuer prior to disbursement of funds. Each note issue is also backed by a personal guarantee by the Director(s) and/or major shareholder of the company. This means that in the event the business issuer is unable to meet its obligations, the guarantors will be personally liable.

In the event of delinquency or default, MoolahSense implements a 3-staged recovery process on behalf of investors, which include sending notices and reminders, activating 3rd party debt collectors and seeking legal solutions.

However, despite these safeguards, investors should pay heed that all investments come with risks. Investors could lose their entire invested amounts if the business fails or enters a default.

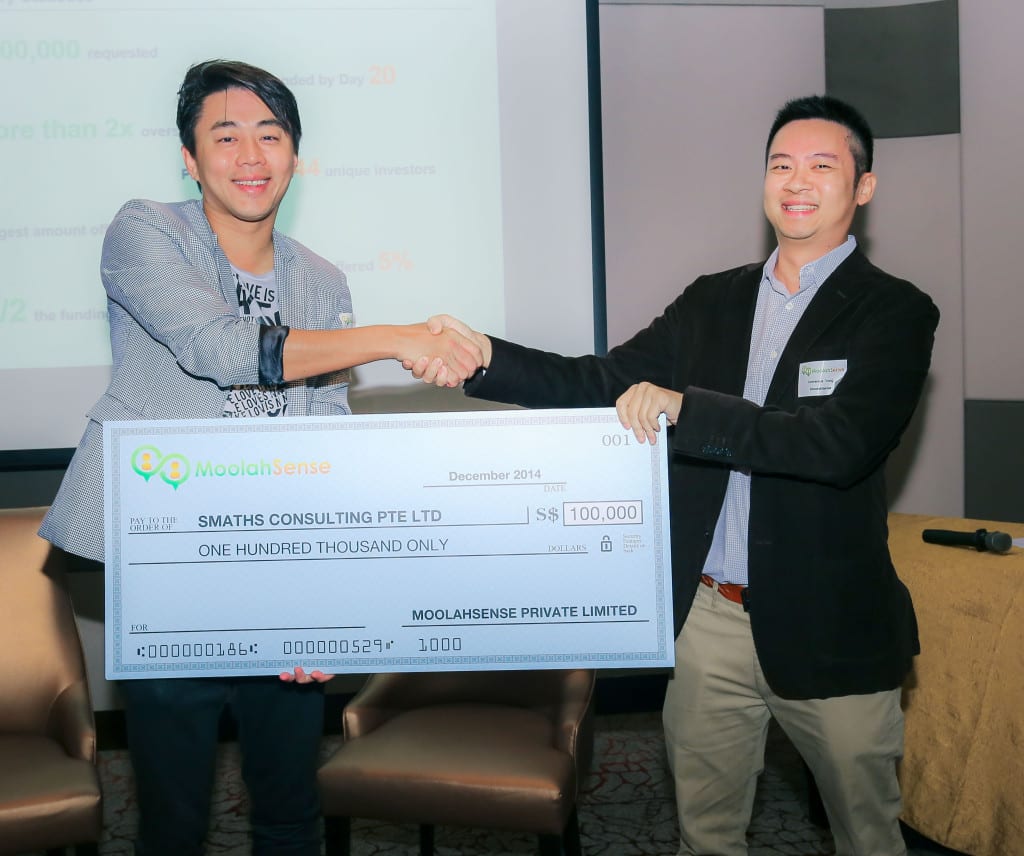

TC: Could you share about your first funding campaign for the edutech firm Smaths Consulting which was recently concluded?

LY: Smaths Consulting is an edu-centre with 3 branches in East Coast and Bukit Timah. In November, they launched a campaign to raise $100,000. Their initial target rate, which was the maximum rate that they could pay for the $100,000 was 18% p.a. (on reducing basis). By the 20th day, the campaign was fully funded. By the 30th day, the campaign was oversubscribed by more than 2x, with participation from 44 unique investors.

When the campaign was concluded, 19 investors were eventually allocated and as a result of the oversubscription, the final allocated rate was 9.9%, or almost half of what Smaths was prepared to pay.

TC: What can companies do to hold a successful crowd funding campaign?

LY: A successful crowdfunding campaign is about communicating its vision, mission and values to instill trust and confidence from prospective investors to support their plan. Here are 6 ingredients to formulate a successful campaign.

- Produce a quality video

- Create an information deck

- Activate both the inner and outer circles

- Have an active social media strategy

- Host info sessions to engage investors

- Provide campaign updates

TC: What happens when the funding target is not reached?

LY: At MoolahSense, the minimum amount is $100,000 or 70% of requested amount, whichever is higher. If the funding target is not reached, the campaign is not successful, the offered amounts will be refunded to the investors.

TC: How will crowd-funding change the landscape of how businesses are run?

LY: In time to come, businesses who can additionally tap on crowd-financing will have a competitive advantage as they are able to secure a resilient source of funding in addition to mainstream finance.

Crowdfunding also extends beyond financing and into branding. In the internet era, the community is the brand. Each successful crowdfunding campaign not only represents the grassroots support a business enjoys but also serves as a powerful form of validation on the business model.

Businesses can also think of using crowdfinancing as a way to reward and further engage its community of supporters by sharing its profitability.

TC: Will sole-proprietorships be targeted in future?

LY: While we recognize that sole-proprietorships are prevalent, their lack of separate personality unfortunately blurs the line on personal lending, which currently may encounter legal issues. Our mission is to support SMEs in all shapes and sizes, so we do hope to serve sole proprietorships one day.

TC: What are some things every business owner should look out for before pursuing crowd funding?

LY: Business owners should be prepared to play an active role in their campaign. Prior to the launch, they should be thinking about the message that they want to send out to prospective investors.

As crowdfunding is a public affair, there are potential downsides if the campaign is not successful. Or if the business is subsequently delinquent on its repayments, it will suffer a reputational hit as many investors will be affected and could attract negative publicity on such events.

TC: Will Moolah sense come up with programmes to assist start ups?

LY: The most concrete ways we can assist start-ups and SMEs is to provide them a vibrant platform where there is an active community of funders to finance and support their entrepreneurship journey.

We also aim to collaborate with established partners in the field who can provide deep knowledge and expertise for our community to tap on.

TC: What will Moolah Sense eventually evolve to be?

LY: MoolahSense has a mission to tackle market failures and address unserved customer needs in the broad landscape of finance.

Today, we can make our biggest initial positive impact in Singapore by solving financing issues for local businesses and helping individual investors on the path to more decent returns that meet their objectives. In so doing, we aim to foster an entrepreneurial culture that is aligned and supportive to our broader national narrative of creating quality jobs.

Beyond Peer to Peer Business Lending, there are many others segments of the industry that remain unserved or inadequately served, and we have those in our sights for future builds to our model.

TC: Thank you very much for joining us.

This interview was conducted for The Columnist, a newsletter by Consulus that offers ideas on business, design and world affairs. The views expressed in this article are those of the interviewee and do not necessarily reflect the views of Consulus.